In line with the ongoing goal to reform, modernize, and simplify the Aruban tax system, the Government and Parliament of Aruba have approved significant changes as part and in line with the tax plan introduced in January, 2023. The key changes include:

- Introduction of the BBO[1] levy at the border and restructuring of the customs duty structure.

- Broadening of the scope of the investment allowance (10%) for foreign investments.

In the next chapter we will elaborate further on these changes.

1. Introduction of the BBO levy at the border and restructuring of the customs duty structure

General

BBO at import

Starting from August 1, 2023, the import of goods[2] will be subject to BBO in order to reduce non-compliance by creating a level-playing field and support public finances. The BBO obligation will be triggered when the goods are imported into Aruba and released for free circulation after meeting all the customs department formalities and requirements. It’s important to note that if goods are held in a bonded warehouse, no BBO or customs duties will be due as long as they remain under the customs department’s supervision. The BBO obligation arises once the goods are brought into free circulation within Aruba. To ease the tax burden and prevent price increases, entrepreneurs importing goods classified as trade goods will have the right to deduct the BBO paid at the border from the BBO amount due upon (re)sale of those goods. There will be no transitional period, meaning goods imported before August 1, 2023, and meeting customs department requirements, will not be subject to additional BBO. The taxable base for BBO will include the customs value of the goods, along with related costs such as shipping, freight, and insurance.

Trade goods

The definition and scope of trade goods are currently under discussion and being updated to ensure clarity across various sectors and industries[3]. While it is still being refined, the Aruba tax authorities provide a general guideline defining trade goods as goods, whether processed or not, that are intended for resale.

It’s important to note that the BBO applied to imported goods intended for the entrepreneur’s own business use cannot be deducted for BBO purposes, unlike goods that are intended for resale.

- [1] BAVP and BAZV are included in the definition of BBO.

- [2] Please note that BBO will be levied if goods are imported into Aruba by entrepreneurs and non-entrepreneurs. However, only entrepreneurs have the right to deduct the BBO paid at the border provided that certain requirements are met.

- [3] For the food and beverage industry, a Ministerial decree will be published which will shed light on the applicability of the BBO at the border and more specifically the definition of goods.

Deduction procedure

Only entrepreneurs who import goods can deduct the BBO charged at the border from their monthly BBO obligation. The deduction from the monthly BBO obligation can be claimed in the month of import, regardless of whether the trade goods are resold. The deduction of the BBO upon import is done simply through the Bo Impuesto portal of the Aruba tax authorities. Therefore, no separate request needs to be submitted. The Aruba tax authorities will implement the approach of granting refunds to taxpayers who are presumed to be eligible by issuing a refund decision (in Dutch: “teruggaafbeschikking”). It is not possible to file an objection letter nor make an appeal against the refund decision. In principle, the period for which a refund can be claimed is within 1 year of the overpayment.

Corrections

In the event that an entrepreneur has overpaid BBO upon importing goods for which a deduction has already been claimed, the excess amount will be adjusted in the BBO declaration for the corresponding period (usually the month). It’s important to note that the same principle applies if there has been an underpayment of BBO at the border, which could potentially also result in sanctions being imposed by the Aruba tax authorities.

Restructuring customs duties

To compensate the implementation of BBO at the border, the existing customs duties structure is undergoing a comprehensive review. As part of this process, the structure will be simplified, and certain tariff adjustments will be introduced to promote a more favorable policy. By reducing specific customs duties and streamlining the system with fewer tariff rates, the likelihood of incorrect or inaccurate completion of customs declarations will be minimized. The extent of rate reductions will vary depending on the type of imported goods. The customs department has indicated that the rates will be reduced for various goods, including but not limited to:

- Energy efficient products;

- Food;

- Construction Material;

- Motorized vehicles.

It is important to note that not all of the mentioned goods will be subject to a lower customs rate. The customs department has specified that only specific types of these goods will be eligible for the lower rate. Additionally, there will be an increase in the rate for certain goods that can be classified as luxury items. These include, but are not limited to:

- Jewelry;

- Cigars;

- Fireworks.

The rates applicable as of August 1, 2023 will be as follow:

2. Broadening of the scope investment allowance (10%)

The introduction of BBO at the border will result in an expansion of the investment allowance of 10%, which will now include investments made in foreign countries. However, this applies only to investments that can be classified as assets. The investment allowance can be claimed with retroactive effect as per January 1, 2023.

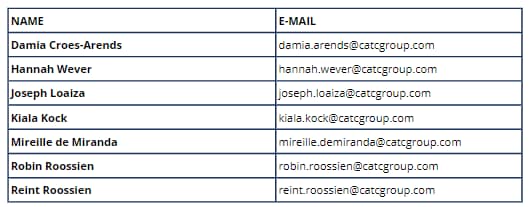

Navigating and properly applying the new changes in tax legislation and regulations can be complex. If you require assistance or have any questions, please feel free to reach out to one of our experienced tax advisors. We are here to help you.

Please note that this newsflash provides information of a general nature and should not be regarded as personal advice.