Below are some highlights for this month.

Click subscribe here at the bottom of the page to receive monthly news and updates about CATC.

Profit tax return

Personal income tax

The deadline for filing the 2021 personal income tax return is December 5, 2022. Please contact us if you need any assistance.

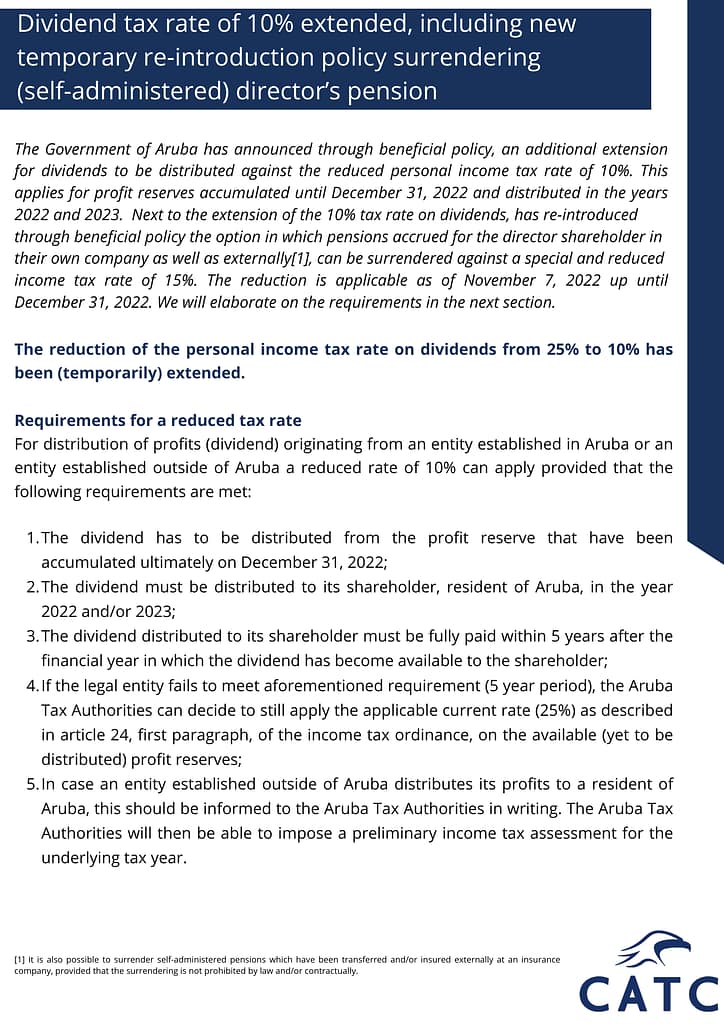

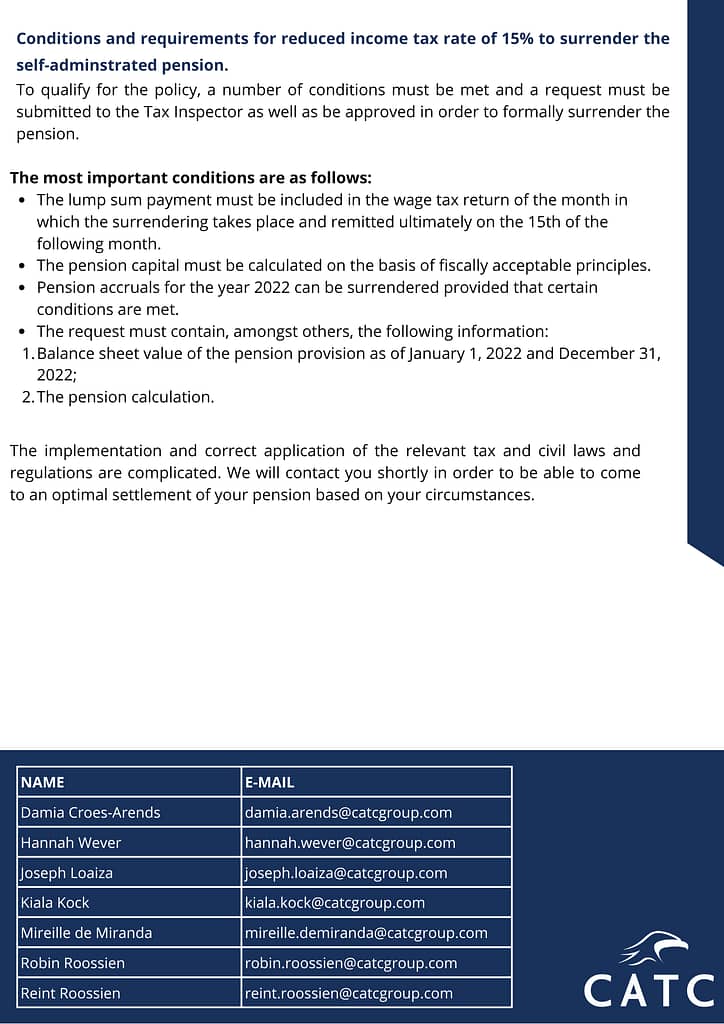

Dividend tax rate of 10% extended, including new temporary re-introduction policy surrendering (self-administered) director’s pension

Essential accounting tips for SME

- Keep your personal and business finances separate.

Instead of keeping your income and other funds in your account, being a business owner means combining your business and personal funds. To keep this hassle-free, open a new bank account for all your business income. This way, you’ll be more organized and keep up with all your transactions. - Keep your records neat.

When your records are neat, you will spend less time searching and more time doing important things. When tax deadlines approach, you’ll be thankful you took a moment to clean up and organize your records. - Remember to stick to deadlines.

Making notes of tax deadlines and setting reminders in advance gives you sufficient time to fill out your tax returns correctly. Contact your tax advisor if you are concerned about any of your deadlines. - Keep all your receipts.

Keep all business-related purchase receipts and track all expenses. It all depends on the type of business you have. - Tax budget

Although you are making a profit, not all of it is yours to keep some will be spent on taxes. A good rule to use is to take the time to plan so you don’t get a big shock at the end of the year. If you have a savings account or similar account, set aside a portion of your income so you can pay taxes and enjoy the rest of your profit. - Familiarize yourself with tax laws.

When it comes to taxes, it’s important to understand which law applies to you and your business so that you know what kind of tax you need to pay. Educate yourself about all things income tax, social security, corporate tax, and business tax rate, and understand what you need to pay. - Create profit and loss statements.

A profit & loss statement (P&L) provides a snapshot of a company’s financial position. It summarizes the company expenses, costs, and revenues over a specified period. It should contain information such as gross profit, net profit, operating profit, and profit before tax. This gives you a quick view of your company’s revenues, expenses, and profits, usually over the last 12 months.