Below are some highlights for this month.

Click subscribe here at the bottom of the page to receive monthly news and updates about CATC.

Ground Tax

The Aruba Tax Authorities announced the 2022 ground tax assessment. Given that a ground tax assessment is based on 5 years (2017 was the first year of the last 5-year period), the year 2022 will be the first year of a new 5-year period (2022-2026). Taxpayers are advised to go through the assessment and verify if this is correct. Any objections against the assessment can be filed within 2 months of the date of the assessment (31 May 2022), thus taxpayers have until August 1, 2022 to file such objection letter. If the assessment is correct, kindly take note of the following payment dates stipulated by law:

For completeness, please be informed that a ground tax assessment can be divided into four (4) terms, one for each quarter in a year.

- Payment date: 30 June 2022

50% over the assessment related to the period January – June (1st and 2nd quarter) - Payment date: 30 September 2022

25% over the assessment related to the period July – September (3rd quarter) - Payment date: 3 January 2023

25% over the assessment related to the period January – June (4th quarter)

Full payment of the 2022 ground tax assessment should be met by January 4, 2023 at the latest. For any questions you may have, please contact one of our Tax advisors.

| NAME | |

| Hannah Wever | hannah.wever@catcgroup.com |

| Joseph Loaiza | joseph.loaiza@catcgroup.com |

| Kiala Kock | kiala.kock@catcgroup.com |

| Mireille de Miranda | mireille.demiranda@catcgroup.com |

| Reint Roossien | reint.roossien@catcgroup.com |

Kiala 5th work anniversary

CATC would like to congratulate our colleague Kiala Kock on her 5th work anniversary. Kiala has been an essential part of the company’s journey and success. We are grateful for the dedication and passion she has shown. Thank you for being with us. Happy Work Anniversary!

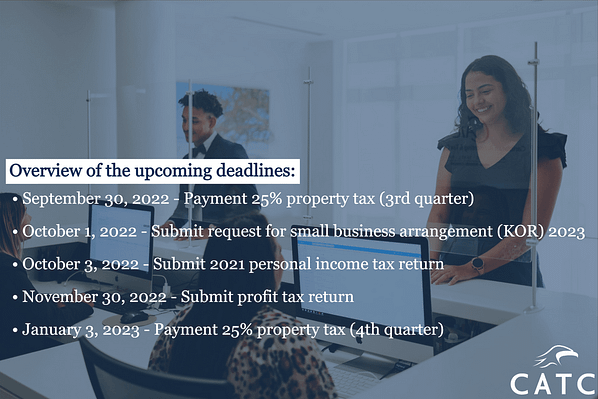

Overview of the upcoming dealines

To help you make sure you don’t miss any important 2022 deadlines, we’ve provided this overview of the upcoming deadlines. Please review the deadlines and let us know if you have any questions. If you need any assistants, contact us at +2975275500 or email us at info@catcgroup.com for more information.

Happy 10th work anniversary Carolen

It’s been a decade since Carolen joined CATC and used her brilliant expertise to help the company achieve great things. She began as part of the internal administration team, and after some time she switched to the payroll department, where she gained a lot of experience. Her dedication and hard work are much appreciated. CATC wanted to send Carolen the warmest anniversary greetings.

The importance of accountancy in a small business

Small business accountancy is a crucial part of running a company. Accountancy allows small businesses to organize, store, and analyze financial information. Using this financial information, you can accurately conclude the financial security of your business.

- Tracking profitability: tracking your company’s profitability lets you follow your earnings over time and plan for ways to improve them in the future. Profitability measures the easy and quick tracking of transactions and determines how much your business earns.

- Maintaining profitability & improved financial management: with accurate accounting, you can tell how much your business is making in terms of income and track your spending to ensure that you have enough cash to cover your business expenses.

- Accountancy helps you prepare for taxation: with proper accountancy, you can determine the types of taxes and calculate the amount payable in advance.

- Easier reporting: As a business owner, you’re responsible for reporting crucial financial data about your firm to potential investors and other stakeholders. Accounting programs that show graphs, charts, and other visual aids make it easier to increase data precision and improve communication when you’re pursuing investors. Examples: QuickBooks Online, Xero, and FreshBooks.

- Evaluate performance & plan for the future: accurate accountancy helps you trace your firm’s financial records and evaluate its performance levels. Accountancy allows you to have a greater understanding of the areas within your business where you can trim costs.

- Communicate with your accountant: in order to make the right decisions you need meaningful information, your accountant can help you transform accounting data into useful and understandable information. By communicating future plans and business challenges with your accountant, the more requested and unrequested advice you can expect in return.

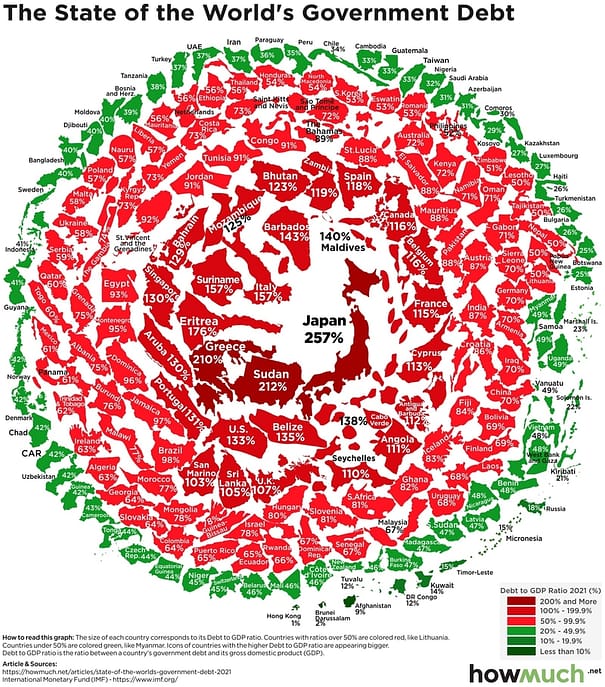

Visualizing the State of Government Debt Around the World (Update, 2021)

The COVID-19 pandemic forced governments around the world to go on a spending spree to prop up their economies. At the same time, fear of the virus combined with strict lockdowns are keeping people at home, causing tax revenues to plummet. How has this ultimately impacted the world’s debt? This visualization breaks down the debt to GDP ratio for each country around the world.

- Japan still has the highest debt to GDP ratio in the world at 257%, which is significantly higher than other developed countries.

- The COVID-19 pandemic significantly increased government debt around the world, with 3 countries now over 200% of debt to GDP and 32 over 100%.

- At the opposite end of the spectrum, a handful of petro countries carry very little debt, including Kuwait (14%), Russia (18%) and Saudi Arabia (31%).

- The coronavirus pandemic is far from over, and many countries are continuing to spend a lot of money to support their economies, suggesting government debt will only continue to get worse in the future.

We created our visualization by taking debt to GDP ratios for each country around the world according to the International Monetary Fund (IMF). The numbers represent figures for 2021. This measure is important because it puts government debt within the context of the size of each country’s economy. For example, the U.S. has a massive economy and can tolerate a lot more debt than somewhere with a comparably smaller economy, like Greece. In this case we adjusted the size of the county and its color to correspond to the level of debt, providing a unique snapshot into the growing debt problem lots of countries are experiencing.

The bad news is that there are lots of countries with ever-increasing government debt. An incredible 32 countries now have debt to GDP ratios larger than 100%, meaning the government carries more debt than the entire annual output for their economies. And there is a small number of countries with very little debt, especially places that rely heavily on oil, like Kuwait (14%), Russia (18%) and Saudi Arabia (31%). The vast majority of places around the world lie somewhere in between these two extremes, carrying somewhere from 50-99% of debt to GDP ratios. From this perspective, the U.S. carries more debt than the average country given the size of its economy (133%), just outside the top 10.

Our visualization represents total government debt as a percentage of GDP for 2021, and it’s an update from the same approach we took in early 2019. Comparing the numbers from before the pandemic to the most recent set of data allows us to see how the pandemic influenced total debt levels. Japan remains the world leader, rising from 238% of GDP to 257%. In fact, there are now 3 countries with a debt to GDP ratio over 200%, including Greece (210%) and Sudan (212%). And the U.S. has risen from 105% to 133%. At the highest level then, no country has moved out of debt over the last couple years, and almost everywhere in the world is going deeper and deeper into the red. And with President Biden proposing trillions in additional spending both to revitalize and transform the American economy, the situation is likely to get even worse before it gets better.